AnthonyFlood.com

Philosophy against Misosophy

Chapter 19 of Murray N. Rothbard, The Logic of Action One: Applications and Criticisms from the Austrian School (London: Edward Elgar, 1997), 294-305. “Reprinted from a paper published by the Foundation for Economic Education, Irvington-on-Hudson, New York, 1957.” After reading Rothbard's dissection of the fallacies of Henry George's land socialism, one wonders, not how anyone could have fallen for them, but how anyone could have done so while professing to grasp economics. See his reply to Georgist critics here.

The Single Tax: Economic and Moral Implications

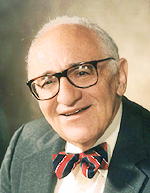

Murray N. Rothbard

Seventy-five years ago, Henry George spelled out his “single tax” program Progress and Poverty, one of the best-selling economic works of all time. According to E. R. Pease, socialist historian and long-time Secretary of the Fabian Society, this volume “beyond all question had more to do with the socialist revival of that period in England than any other book.”

Most present-day economists ignore the land question and Henry George altogether. Land is treated as simply capital, with no special features or problems. Yet there is a land question, and ignoring it does not lay the matter to rest. The Georgists have raised, and continue to raise, questions that need answering. A point-by-point examination of single tax theory is long overdue.

According to the single tax theory, individuals have the natural right to own themselves and the property they create. Hence they have the right to own the capital and consumer goods they produce. Land, however (meaning all original gifts of nature), is a different matter, they say. Land is God-given. Being God-given, none can justly belong to any individual; all land properly belongs to society as a whole.

Single taxers do not deny that land is improved by man; forests are cleared, soil is tilled, houses and factories are built. But they would separate the economic value of the improvements from the basic, or “site,” value of the original land. The former would continue to be owned by private owners; the latter would accrue to “society”—that is, to society’s representative, the government. Rather than nationalize land outright, the single taxers would levy a 100 percent tax on the annual land rent—the annual income from the site—which amounts to the same thing as outright nationalization.

Georgists anticipate that the revenue from such tax on land would suffice to conduct all the operations of government—hence the name “single tax.” As population increases and civilization develops, land values (especially urban site values) increase, and single taxers expect that confiscation of this “unearned increment” will keep public coffers overflowing far into the future. The increment is said to be “unearned” because it stems from the growth of civilization rather than from any productive activities of the site owner.

Almost everyone would agree that the abolition of all the other taxes would lift a great blight from the energies of the people. But Georgists generally go beyond this to contend that their single tax would not harm production—since the tax is only levied on the basic site and not on the man-made improvements. In fact, they assert the single tax will spur production; it will penalize idle land and force landowners to develop their property in order to lower their tax burden.

Idle land, indeed, plays a large part in single tax theory, which contends that wicked speculators, holding out for their unearned increment, keep sites off the market, and cause a scarcity of land; that this speculation even causes depressions. A single tax, confiscating unearned increment, is supposed to eliminate land speculation, and so cure depressions and even poverty itself.

How can the single taxers give such importance to their program? How can they offer it as a panacea to end poverty? A clue may be found in the following comments about the plight of the undeveloped countries:

Most of us have learned to believe that the people of . . . so-called backward nations are poor because they lack capital. Since . . . capital is nothing more than . . . human energy combined with land in one form or another, the absence of capital too often suggests that there is a shortage of land or of labor in backward countries like India or China. But that isn’t true. For these “poor” countries have many times more land and labor than they can use . . . they have everything it takes—both land and labor—to produce as much capital as people anywhere.1

And since these countries have plenty of land and labor, the trouble must be idle land withheld from production by speculative landlords!

The deficiency in that argument is the neglect of the time factor in production. Capital is the product of human energy and land . . . and time. The time-block is the reason that people must abstain from consumption, and save. Laboriously, these savings are invested in capital goods. We are further along the road to a high standard of living than India or China because we and our ancestors have saved and invested in capital goods, building up a great structure of capital. India and China, too, could achieve our living standards after years of saving and investment.

The single tax theory is further defective in that it runs up against a grave practical problem. How will the annual tax on land be levied? In many cases, the same person owns both the site and the man-made improvement, and buys and sells both site and improvement together, in a single package. How, then, will the government be able to separate site value from improvement value? No doubt, the single taxers would hire an army of tax assessors. But assessment is purely an arbitrary act and cannot be anything else. And being under the control of politics, it becomes purely a political act as well. Value can only be determined in exchange on the market. It cannot be determined by outside observers.

In the case of agricultural land, for instance, it is clear that you cannot, in practice, separate the value of the original ground from the value of the cleared, prepared, and tilled soil. This is obviously impossible, and even assessors would not attempt the task.

But the single taxers are also interested in urban land where the value of the lot is often separable, on the market, from the value of the building over it. Even so, the urban lot today is not the site as found in nature. Man had to find it, clear it, fence it, drain it, and the like; so the value of an “unimproved” lot includes the fruits of man-made improvements.

Thus, pure site value could never be found in practice, and the single tax program could not be installed except by arbitrary authority. But let us waive this fatal flaw for the moment and pursue the rest of the theory. Let us suppose that pure site value could be found. Would a single tax program

then be wise?Well, what about idle land? Should the sight of it alarm us? On the contrary, we should thank our stars for one of the great economic facts of nature: that labor is scarce relative to land. It is a fact that there is more land available in the world, even quite useful land, than there is labor to keep it employed. This is a cause for rejoicing, not lament.

Since labor is scarce relative to land, and much land must therefore remain idle, any attempt to force all land into production would bring economic disaster. Forcing all land into use would take labor and capital away from more productive uses, and compel their wasteful employment on land, a disservice to consumers.

The single taxers claim that the tax could not possibly have any ill effects; that it could not hamper production because the site is already God-given, and man does not have to produce it; that, therefore, taxing the earnings from a site could not restrict production, as do all other taxes.2 This claim rests on a fundamental assumption—the hard core of single tax doctrine: Since the site-owner performs no productive service he is, therefore, a parasite and an exploiter, and so taxing 100 percent of his income could not hamper production. But this assumption is totally false. The owner of land does perform a very valuable productive service, a service completely separate from that of the man who builds on, and improves, the land. The site owner brings sites into use and allocates them to the most productive user. He can only earn the highest ground rents from his land by allocating the site to those users and uses that will satisfy the consumers in the best possible way. We have seen already that the site owner must decide whether or not to work a plot of land or keep it idle. He must also decide which use the land will best satisfy. In doing so, he also insures that each use is situated on its most productive location. A single tax would utterly destroy the market’s important job of supplying efficient locations for all man’s productive activities, and the efficient use of available land.

A 100 percent tax on rent would cause the capital value of all land to fall promptly to zero. Since owners could not obtain any net rent, the sites would become valueless on the market. From that point on, sites, in short, would be free. Further, since all rent would be siphoned off to the government, there would be no incentive for owners to charge any rent at all. Rent would be zero as well, and rentals would thus be free.

The first consequence of the single tax, then, is that no revenue would accrue from it. Far from supplying all the revenue of government, the single tax would yield no revenue at all. For if rents are zero, a 100 percent tax on rents will also yield nothing.

In our world, the only naturally free goods are those that are superabundant—like air. Goods that are scarce, and therefore the object of human action, command a price on the market. These goods are the ones that come into individual ownership. Land generally is abundant in relation to labor, but lands, particularly the better lands, are scarce relative to their possible uses.

All productive lands, therefore, command a price and earn rents. Compelling any economic goods to be free wreaks economic havoc. Specifically, a 100 percent tax means that land sites pass from individual ownership into a state of no-ownership as their price is forced to zero. Since no income can be earned from the sites, people will treat the sites as if they were free—as if they were superabundant. But we know they are not superabundant; they are highly scarce. The result is to introduce complete chaos in land sites. Specifically, the very scarce locations—those in high demand—will no longer command a higher price than the poorer sites. Therefore, the market will no longer be able to insure that these locations will go to the most efficient bidders. Instead, everyone will rush to grab the best locations. A wild stampede will ensue for the choice downtown urban locations, which will now be no more expensive than lots in the most dilapidated suburbs. There will be great overcrowding in the downtown areas and underuse of outlying areas. As in other types of price ceilings, favoritism and “queuing up” will settle allocation, instead of economic efficiency. In short, there will be land waste on a huge scale. Not only will there be no incentive for those in power to allocate the sites efficiently; there will also be no market rents and therefore no way that anyone could find out how to allocate sites properly.

In brief, the inevitable result of a single tax would be nothing less than locational chaos. And since location—land—must enter into the production of every good, chaos would be injected into every aspect of economic calculation. Waste in location leads to waste and misallocation of all productive resources.

The government, of course, might try to combat the disappearance of market rentals by levying an arbitrary assessment, declaring by fiat that every rent is “really” such and such, and taxing the site owner 100 percent of that amount. Such arbitrary decrees would bring in revenue, but they would only compound chaos further. Since the rental market would no longer exist, the government could never guess what the rent would be on the free market. Some users would be paying a tax of more than 100 percent of the true rent, and the use of these sites would be discouraged. Finally, private owners would still have no incentive to manage and allocate their sites efficiently. An arbitrary tax in the face of zero rentals is a long step toward replacing a state of no-ownership by government ownership.

In this situation, the government would undoubtedly try to bring order out of chaos by nationalizing (or municipalizing) land outright. For in any economy, a useful resource cannot go unowned without chaos setting in; somebody must manage and own—either private individuals or the government.

George himself expected that the single tax would “accomplish the same thing (as land nationalization) in a simpler, easier, and quieter way.”3 The hollow form of private ownership in land would remain, but the substance would have been drained away.

Government ownership of land would end one particular form of utter chaos brought about by the single tax, but it would add other great problems. It would raise all the problems created by any government ownership, and on a very large scale.4 In short, there would be no incentive for government officials to allocate sites efficiently, and land would be allocated on the basis of politics and favoritism. Efficient allocation also would be impossible, due to the inherent defects of government operation; the absence of a profit and loss test, the conscription of initial capital, the coercion of revenue—the calculational chaos that government ownership and invasion of the free market create. Since land must be used in every productive activity, this chaos would permeate the entire economy. Socialization as a remedy for the evils of the single tax would be a jump from the frying pan into the fire.

Thus we see that private site owners, by allocating sites to productive uses, perform an extremely important service to all members of society. It is a service we would not do without, and the income to owners is but their return for this service.

The view that the site owner is nonproductive is a hangover from the old Smith-Ricardo doctrine that “productive” labor must be employed on material objects. The site owner does not solely transform matter into a more useful shape, as the builder does, though he may do that in addition. Lawyers and musicians provide intangible services, just as site owners perform a truly vital function although it may not be a directly physical one.

What about the maligned speculator, the holder of idle land? He, too, performs an important service—a subdivision of the general site-owner function. The speculator allocates sites over time. Even if a speculator reaps an “unearned increment” of capital value by holding land as its price rises, he can gain no such increment by keeping land idle. Why shouldn’t he use the land and earn rents in addition to his capital gain? Idle land by itself cannot benefit him. The reason he keeps the land apparently idle, therefore, is either that the land is still too poor to be used by current labor and capital goods, or that it is not yet clear which use for the site is best. The “speculative” landowner has the difficult job of deciding when to commit the site to a specific use. A wrong decision would waste the land. By waiting and judging, the speculative landowner picks the right moment for bringing his land into use, and the right employment for the land. Land speculators, therefore, perform as vital a market function as their fellow site owners whose land is already in use. Land that seems idle to a passer-by probably is not idle in the eyes of its owner who is responsible for its use.

We have seen that the economic arguments for the single tax are fallacious at every important turn, and that the economic effects of a single tax would be disastrous indeed. But we should not neglect the moral arguments. Undoubtedly, the passion and fervor that have marked the single taxers through the years stems from their moral belief in the injustice of private ownership of land. Anyone who holds this belief will not be fully satisfied with explanations of the economic error and dangers of the single tax. He will continue to call for battle against what he believes to be a moral injustice.

The single taxers complain that site owners benefit unjustly by the rise and development of civilization. As population grows and the economy advances, site owners reap the benefit through a rise in land values. Is it justice for site owners who contribute little or nothing to this advance, to reap such handsome rewards?

All of us reap the benefits of the social division of labor, and the capital invested by our ancestors. We all gain from an expanding market—and the landlord is no exception. The landowner is not the only one who gains an “unearned increment” from these changes. All of us do. Is he, or are we, to be confiscated and taxed out of this happiness in the fruits of advancement? Who in “fairness” could receive the loot? Certainly it could not be given to our dead ancestors, who became our benefactors by investing in capital.5

As the supply of capital goods increases, land and labor become more scarce in relation to them, and therefore more productive. The incomes both of laborers and landowners increase as civilization expands. As a matter of fact, the landowner does not reap as much reward as the laborer from a progressing economy. For landowning is a business like any other, the return from which is regulated and minimized, in the long run, by competition. If land temporarily offers a higher rate of return, more people invest in it, thereby driving up its market price, or capital value, until the annual rate of return falls to the level of all other lines of business. The man who buys a site in mid-Manhattan now will earn no more than in any other business. He will only earn more if the market has not fully discounted future increases in rent through increasing the capital value of the land. In other words, he can only earn more if he can pick up a bargain. And he can only do this if, like other successful profit-makers, his foresight is better than that of his fellows.

Thus, the only landowners who reap special gains from progress are the ones more farsighted than their fellows—the ones who earn more than the usual rate of return by accurately predicting future developments. Is it bad for the rest of us, or is it good, that sites go into the hands of those men with the most foresight and knowledge of that site?

Among the specially farsighted is the original pioneer—the man who first found a new site and acquired ownership. Furthermore, in the act of clearing the site, fencing it, and the like, the pioneer inextricably mixes his labor with the original land. Confiscation of land would not only retroactively rob heroic men who cleared the wilderness, it would completely discourage any future pioneering efforts. Why should anyone find new sites and bring them into use when the gain will be confiscated? And how moral is this confiscation?

We have still to deal with the critical core of single tax moral theory—that no individual has the right to own value in land. Single taxers agree with libertarians that every individual has the natural right to own himself and the property he creates, and to transmit it to his heirs and assigns. They part company with libertarians in challenging the individual’s right to claim property in original, God-given, land. Since it is God-given, they say, the land should belong to society as a whole, and each individual should have an equal right to its use. They say, therefore, that appropriation of any land by an individual is immoral.

We can accept the premise that land is God-given, but we cannot therefore infer that it is given to society; it is given for the use of individual persons. Talents, health, beauty may all be said to be God-given, but obviously they are properties of individuals, not of society. Society cannot own anything. There is no entity called society; there are only interacting individuals. Ownership of property means control over use and the reaping of rewards from that use. When the State owns, or virtually owns, property, in no sense is society the owner. The government officials are the true owners, whatever the legal fiction adopted. Public ownership is only a fiction; actually, when the government owns anything, the mass of the public are in no sense owners. You or I cannot sell our “shares” in TVA, for example.

Any attempt by society to exercise the function of land ownership would mean land nationalization. Nationalization would not eliminate ownership by individuals; it would simply transfer this ownership from producers to bureaucrats.

Neither can any scheme exist where every individual will have “equal access” to the use of land. How could this possibly happen? How can a man in Timbuktu have as equal access as a New Yorker to Broadway and 42nd Street? The only way such equality could be enforced is for no one to use any land at all. But this would mean the end of the human race. The only type of equal access, or equal right to land, that makes any sense is precisely the equal access through private ownership and control on the free market—where every man can buy land at the market price.

The single taxer might still claim that individual ownership is immoral, even if he can find no plausible remedy. But he would be wrong. For his claim is self-contradictory. A man cannot produce anything without the cooperation of original land, if only as standing room. A man cannot produce anything by his labor alone. He must mix his labor with original land, as standing room and as raw materials to be transformed into more valuable products.

Man comes into the world with just himself and the world around him—with the land and natural resources given him by nature. He takes these resources and transforms them by his labor and energy into goods more useful to man. Therefore, if an individual cannot own original land, neither can he in the same sense own the fruits of his labor. The single taxers cannot have their cake and eat it; they cannot permit a man to own the fruits of his labor while denying him ownership of the original materials which he uses and transforms. It is either one or the other. To own his product, a man must also own the material which was originally God-given, and now has been remolded by him. Now that his labor has been inextricably mixed with land, he cannot be deprived of one without being

deprived of the other.But if a producer is not entitled to the fruits of his labor, who is entitled to them? It is difficult to see why a newborn Pakistani baby should have a moral claim to ownership of a piece of Iowa land someone has just transformed into a wheat field. Property in its original state is unused and unowned. The single taxers may claim that the whole world really “owns” it, but if no one has yet used it, it is really owned by no one. The pioneer, the first user of this land, is the man who first brings this simple valueless thing into production and social use. It is difficult to see the morality of depriving him of ownership in favor of people who never got within a thousand miles of the land, and whose only claim to its title is the simple fact of being born—who may not even know of the existence of the property over which they are supposed to have claim.

Surely, the moral course is to grant ownership of land to the person who had the enterprise to bring it into use, the one who made the land productive. The moral issue will be even clearer if we consider the case of animals. Animals are “economic land”—since they are original nature—given resources. Yet will anyone deny full title to a horse to the man who finds and domesticates it? Or should every person in the world put in his claim to one two-billionth of the horse—or to one two-billionth of a government assessor’s estimate of the “original horse’s” worth? Yet this is precisely the single taxer’s ethic. In all cases of land, some man takes previously undomesticated, “wild” land, and “tames” it by putting it to productive use. Mixing his labor with land sites should give him just as clear a title as in the case of animals.

As two eminent French economists have written “Nature has been appropriated by him (man) for his use; she has become his own; she is his property. This property is legitimate; it constitutes a right as sacred for man as is the free exercise of his faculties. Before him, there was scarcely anything but matter; since him, and by him, there is interchangeable wealth. The producer has left a fragment of his own person in the things which . . . may hence be regarded as a prolongation of the faculties of man acting upon external nature. As a free being he belongs to himself; that is to say the productive force, is himself; now, the cause, that is to say, the wealth produced, is still himself. Who shall dare contest title of ownership so clearly marked by the seal of his personality?”6

Notes

1 Phil Grant, The Wonderful Wealth Machine (New York: Devin-Adair, 1953), pp. 105-7.2 Unfortunately, most economists have accepted this claim uncritically and only dispute the practicality of the single tax program.

3 Henry George, Progress and Poverty (New York: Modern Library, 1916), p. 404.

4 For a further discussion of these problems, see the author’s “Government in Business,” The Freeman (September 1956): 39-41.

5 “’What gives value to land?,’ asks Rev. Hugh O. Pentecost. And he answers: ‘The presence of population-the community. Then rent, or the value of land, morally belongs to the community.’ What gives value to Mr. Pentecost’s preaching? The presence of population—salary, or the value of his preaching, morally belongs to the community.” Benjamin R. Tucker, Instead of a Book (New York: B.R. Tucker, 1893), p. 357. Also see Leonard E. Read, “Unearned Riches,” in On Freedom and Free Enterprise, Mary Sennholz, ed. (Princeton: D. Van Nostrand, 1956), pp. 188-95; and F.A. Harper, “The Greatest Economic Charity,” in ibid., pp. 94-108.

6 Leon Wolowski and Emilet Levasseur, “Property” in Lalor’s Cyclopedia of Political Science (Chicago: M.B. Cary, 1884), p. 392.

Posted July 11, 2008